Credit Cards

Choose from 60+ credit cards, each offering a variety of features and benefits. Get instant approval with a digital application.

Maximize Rewards

100% Digital Process

Instant Approval

60+ Cards to Choose

Your Trusted Partner for Credit Cards

24/7 Customer Support

We provide the best customer support for our customers

60+ Cards to Choose From

Find the most popular credit cards in India by comparing them

Instant Approval

Explore Visa card options & apply for pre-qualified credit cards

100% Digital Process

Enjoy a 100% digital, hassle-free application process

Best Credit Cards in India

Find a wide range of credit cards, from entry-level to super-premium, designed specifically to match your spending habits and financial profiles

LIC Axis Bank Platinum Credit Card

Lost card liability insurance

- 2 reward points for every Rs. 100 spent on LIC premium payments

- Up to 20% dining discount at partner restaurants under the Axis Bank Dining Delights Program

- Convert transactions of Rs. 2,500 and above into easy EMI

Au Small Finance Bank Lit Card

No joining and annual fees

- 3 months Amazon Prime Membership, at Rs. 299 for 90 days

- 5% cashback, up to Rs. 500 in 30 days, on grocery spends, at a fee of Rs. 299 for 90 days

- 10 reward points per Rs. 100 spent on online purchases, at a fee of Rs. 299 for 90 days

Marriott Bonvoy HDFC Credit Card

Unlimited airport lounge access

- 8 Marriott Bonvoy Points per Rs. 150 spent at hotels participating in Marriott Bonvoy

- 1 Free Night Award on making the first eligible transaction or on levy of joining fee

- Zero lost card liability in case of fraudulent transactions made on the credit card

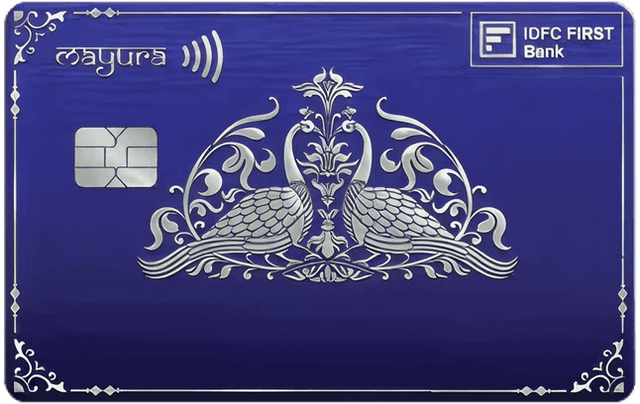

IDFC FIRST Mayura Credit Card

10X reward points on monthly spends

- 5X reward points on monthly spends up to Rs. 20,000

- Reimbursement of non-refundable flight & hotel cancellation of up to Rs. 50,000, twice a year

- Up to 16 complimentary international lounge visits in a year, maximum 4 per quarter

HDFC Bank UPI RuPay Credit Card

Up to 3% CashPoints

- 2% CashPoints: On utility spends, up to 500 points per month

- 1% CashPoints: On all other purchases, up to 500 points per month

- Card annual fee can be waived off by spending Rs. 25,000 or above during the previous calendar year.

AU NOMO Credit Card

Secured Credit Card (Backed by FD)

- 1 reward point for every Rs. 100 spent on utility and insurance transactions

- 2 reward points for every Rs. 100 spent on retail purchases

- 2 complimentary railway lounge access per quarter

Compare Best Credit Card Companies

Discover the perfect credit card for your spending habits and financial profile, from entry-level to super-premium

Lifetime Free Credit Cards

Relaxed eligibility criteria with no joining or renewal fees

Zero annual fee

Basic rewards

Easy approval

Cashback Credit Cards

Cashback on purchases across all categories

Direct cashback

Simple rewards

Statement credits

Rewards Credit Cards

For flexible redemption, earn points on every transaction

Flexible redemption

Bonus categories

Welcome bonus

Travel Credit Cards

Benefits such as air miles and lounge access

Airport lounge access

Air miles

Travel insurance

Shopping Credit Cards

Retail and e-commerce rewards have been enhanced

Airport lounge access

Air miles

Travel insurance

Co-branded Credit Cards

Benefits associated with specific brand partnerships

Flexible redemption

Bonus categories

Welcome bonus

Fuel Credit Cards

Reward points and cashbacks on fuel purchases

Direct cashback

Simple rewards

Statement credits

Super Premium Credit Cards

High-net-worth individuals can enjoy luxury benefits

Concierge services

Unlimited lounge access

Golf privileges

5 Smart Tips to Manage Your Credit Card

Pay your total outstanding balance on time to avoid interest charges and preserve a strong CIBIL score.

To benefit from reduced interest rates and manageable installments, convert large expenses into EMIs.

Avoid cash withdrawals because they incur charges instantly, as they don’t have an interest-free period.

Keep track of your spending on a regular basis to avoid financial strain and stay within your budget.

Avoid multiple credit card applications, as your credit score may be impacted by repeated hard inquiries.

Do’s and Don’ts for Credit Cards

How to Choose the Right Credit Card?

You should choose a credit card that offers the highest rewards on spending in the categories that you spend most of your time in

Choosing the right credit card for you depends on your credit profile, so you should make sure you understand it before selecting one

The best credit card for you should be one that suits your needs, so you should apply for it if you are looking for one

Having a clear understanding of all the terms, hidden charges, and penalties is very important before you apply for a loan

Ready to Get Your Perfect Credit Card?

Compare 60+ credit cards, get instant approval, and start earning rewards today